Up to 20,000 farmers could be affected.

Ulster Bank has announced a phased withdrawal from the Irish market.

The bank's wind down will take place over a number of years, with no immediate change for customers.

In a statement, Ulster Bank says it's made a non-binding agreement with AIB for the sale of 4 billion euro worth of performing commercial loans.

It's also in early discussions with Permanent TSB regarding other parts of the business.

Up to 20,000 farmers in Ireland will be affected by the decision.

President of the Irish Farmers' Association, Toomervara's Tim Cullinan says the government needs to intervene:

Announcing the phased withdrawal, Ulster Bank Chief Executive Officer, Jane Howard said:

“The decision by NatWest to withdraw from this market is hugely disappointing and today will be a difficult and worrying time for our colleagues across the Bank. It may also lead to customer questions and concerns as to how this decision may impact them and their day-to-day banking needs.

“I want to be clear that there will be no change for customers today, changes will happen over the coming years. Ulster Bank will continue to offer a full banking service in our branches, online and through normal channels for existing and new customers for the foreseeable future. Customers do not need to take any action as a consequence of this announcement. We will communicate with customers in a timely manner over the coming weeks and months.

“We will now consult with employee representative bodies to determine how best to plan and manage an orderly withdrawal of the Bank over the coming years. There will be no new compulsory departures from the Bank this year. I am acutely conscious of our responsibilities to our colleagues and I am wholeheartedly committed to managing this process in a fair and responsible manner.

“The phased withdrawal will include the careful and responsible execution of a strategy over time to deliver constructive solutions for our customers and their banking services within the Republic of Ireland.”

Offaly Heritage Site Opening Temporary Cafe

Offaly Heritage Site Opening Temporary Cafe

IFI Allocate €40k Funding To Laois And Offaly River

IFI Allocate €40k Funding To Laois And Offaly River

Gen Z Drink Less Alcohol

Gen Z Drink Less Alcohol

Over 32,000 Outpatients Waiting In Midlands Hospitals

Over 32,000 Outpatients Waiting In Midlands Hospitals

Laois Motorist Parks In Disabled Bay Without Permit To get Ice Cream

Laois Motorist Parks In Disabled Bay Without Permit To get Ice Cream

Scripts Festival Returns To Midlands For 2025

Scripts Festival Returns To Midlands For 2025

Concerns Raised By Residents On Laois Solar Farm

Concerns Raised By Residents On Laois Solar Farm

Ballycommon Trailhead Officially Opens

Ballycommon Trailhead Officially Opens

'Drug Users More Often Victims Than Criminals'

'Drug Users More Often Victims Than Criminals'

Michael O'Leary Criticizes Environmental Taxes On Airlines

Michael O'Leary Criticizes Environmental Taxes On Airlines

Westmeath Garda Station To Host Open Day

Westmeath Garda Station To Host Open Day

Midlands To Hit Highs Of 29 Degrees

Midlands To Hit Highs Of 29 Degrees

Westmeath Bridge Could Be Named To Honour Former Minister

Westmeath Bridge Could Be Named To Honour Former Minister

Offaly Man Who Died in Workplace Accident To Be Laid To Rest On Saturday

Offaly Man Who Died in Workplace Accident To Be Laid To Rest On Saturday

Financial Pressure For Families Waiting To Move Into Laois Estate

Financial Pressure For Families Waiting To Move Into Laois Estate

Former Midlands MEP Emerging As Favourite To Be Fine Gael's Presidential Candidate

Former Midlands MEP Emerging As Favourite To Be Fine Gael's Presidential Candidate

Missing Woman Believed To Have Traveled To Dublin On Day Of Disappearance

Missing Woman Believed To Have Traveled To Dublin On Day Of Disappearance

Reduction In Hiring New Graduates Due To AI

Reduction In Hiring New Graduates Due To AI

Plans For €1bn Westmeath Data Centre Campus And Solar Farm

Plans For €1bn Westmeath Data Centre Campus And Solar Farm

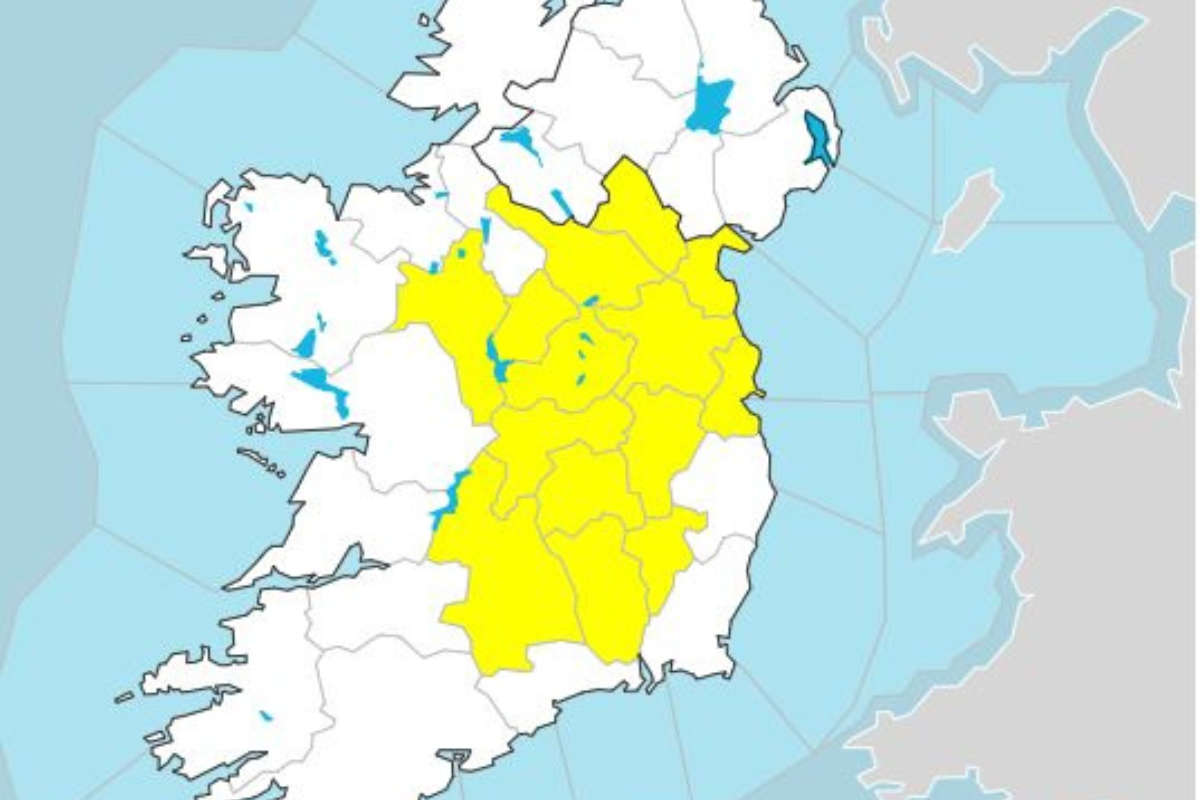

Status Yellow High Temperature Warnings For Midlands

Status Yellow High Temperature Warnings For Midlands