Longford-Westmeath TD Peter Burke feels it's important to keep hospitality jobs afloat as a VAT rate cut could be delayed.

The Government is considering delaying the introduction of a VAT rate cut for the hospitality sector.

Finance Minister Paschal Donohoe said the full year cost of implementing a 9% VAT cut would be up to a billion euro.

That's two thirds of all the tax cut money the Government plans to have in Budget 2026 - minimising room for measures elsewhere.

The coalition is now considering not implementing the measure until the middle of next year to reduce the immediate cost.

Enterprise Minister and Longford-Westmeath TD Peter Burke says it's important to avoid job losses in the sector:

Tax Strategy Papers released this afternoon put the cost of the measure at almost €900 million.

But €135 million of that could be saved by not giving the tax breaks to hotels and B&Bs.

Minister Burke says he isn't conceding to any delay in the rate cut:

Deadline For Observations on Westmeath Community Centre Tomorrow

Deadline For Observations on Westmeath Community Centre Tomorrow

Laois County Council Launch Youth Theatre Pilot Proposals

Laois County Council Launch Youth Theatre Pilot Proposals

OPW Minister To Visit Waterford In March After Flooding

OPW Minister To Visit Waterford In March After Flooding

Epilepsy Day Highlights Over Two Thousand People With Condition In Midlands

Epilepsy Day Highlights Over Two Thousand People With Condition In Midlands

State Pathologist Reviews Ancient Human Remains Found In Westmeath

State Pathologist Reviews Ancient Human Remains Found In Westmeath

Revenue Seizes Over €105k In Midlands, Kilkenny, Dublin And Rosslare

Revenue Seizes Over €105k In Midlands, Kilkenny, Dublin And Rosslare

Family of Offaly Father Seek Publication Of Report Into Death

Family of Offaly Father Seek Publication Of Report Into Death

Midlands Stars Survive Fright Night Under The Glitter Ball

Midlands Stars Survive Fright Night Under The Glitter Ball

Westmeath Library Reopening

Westmeath Library Reopening

Gardaí Make €1.7m Midlands Drug Seizure

Gardaí Make €1.7m Midlands Drug Seizure

Over €150k Raised For Offaly Teen's Recovery

Over €150k Raised For Offaly Teen's Recovery

Two Men Arrested Following Guns And Ammunition Seizure In Midlands

Two Men Arrested Following Guns And Ammunition Seizure In Midlands

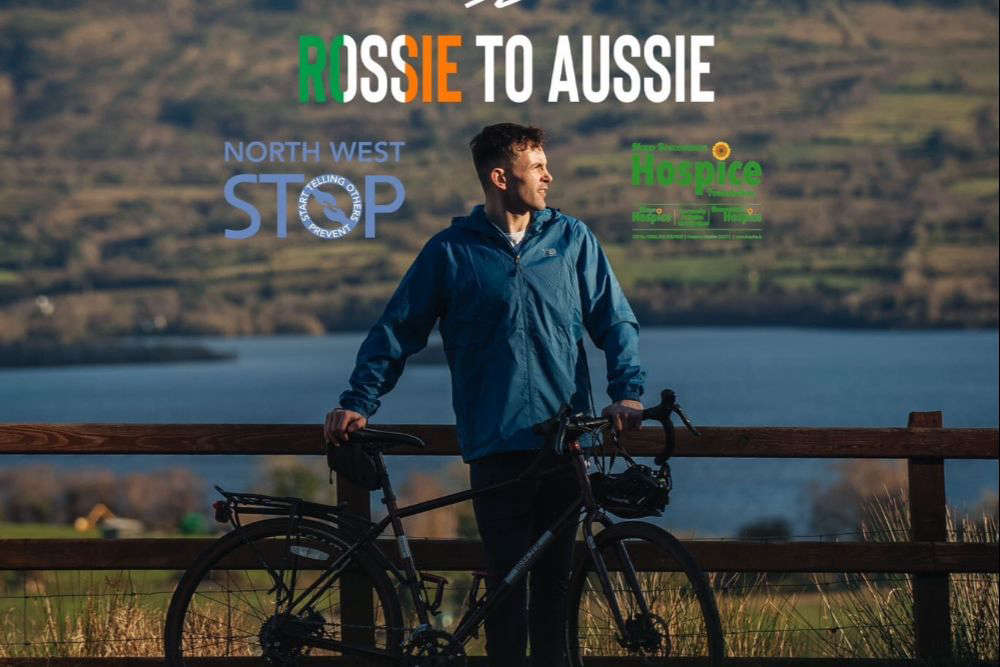

Rossie To Aussie Nurse Arrives Down Under For Fundraiser

Rossie To Aussie Nurse Arrives Down Under For Fundraiser

Laois IFA Hold AGM To Demand Bord Bia Chair’s Resignation

Laois IFA Hold AGM To Demand Bord Bia Chair’s Resignation

Westmeath Man Pleads Guilty To Attacking Ex-Girlfriend's Car

Westmeath Man Pleads Guilty To Attacking Ex-Girlfriend's Car

Legal Aid Costs For International Protection Cases Jumps 429% Since 2020

Legal Aid Costs For International Protection Cases Jumps 429% Since 2020

Love Luck Varies Across The Midlands This Valentine’s Day

Love Luck Varies Across The Midlands This Valentine’s Day

Supermacs Nominated For Multiple Digital Awards

Supermacs Nominated For Multiple Digital Awards

Education Minister Confirms Tender For Major Expansion Of Laois School

Education Minister Confirms Tender For Major Expansion Of Laois School

Weekend Celebrations As Midlands Lotto Player Scoops Over €195k

Weekend Celebrations As Midlands Lotto Player Scoops Over €195k