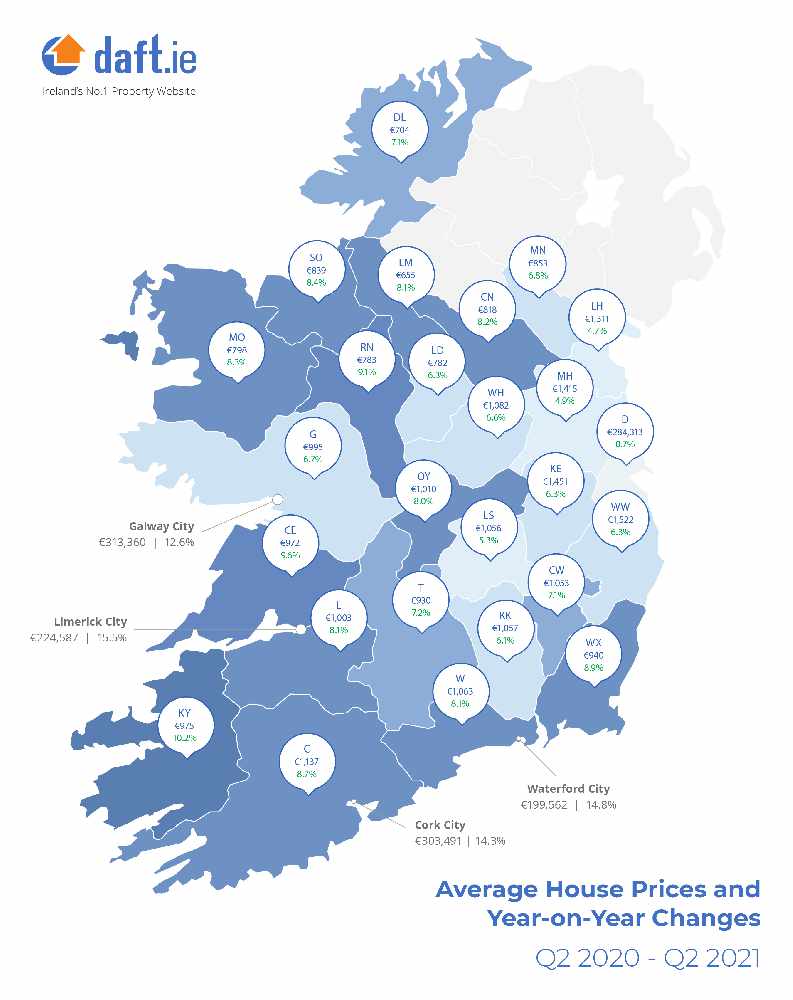

The average asking price in Westmeath is now €232,000 and it's not far behind in Laois and Offaly.

The average asking price for property in the midlands has increased by at least 15% in the last 12 months.

Figures from Daft.ie show the average house price is now €232,000 in Westmeath, €214,000 in Offaly and €208,000 in Laois.

That represents an increase of 15.1%, 17.9% and 17.1% respectively.

Ronan Lyons from Daft.ie says more people are looking to buy homes outside the capital:

Mr. Lyons is predicting the property price gap between the midlands and Dublin will be smaller than ever before following the pandemic.

Today's report also highlights Laois and Westmeath as having some of the largest number of new builds, purchased in the country.

Mr. Lyons says one particular fallout of covid-19 is inflating the market:

Reacting to the news, Pat Davitt, IPAV Chief Executive said:

“Indeed, in the current market with supply and demand being the most seriously out of kilter it has been in living memory, our members are seeing even higher prices achieved for more exclusive properties,”

While many commentators are talking about the property highs of 2007 as the holy grail and above that prices should not go, many areas are now seeing prices about the 2007 levels and the rest will follow soon.

In 2007 interest rates were very high, there were no real long-term fixed interest rates and there was a glut of properties. In 2021 it is completely different thanks to very much improved fixed interest rates, purchasers know how much they will pay for a property for up to 30 years and interest rates are low, even though still higher that our Euro area counterparts.

In the present market one can see new highs for 2021 and probably more for 2022. It’s not a market agents like but many purchasers are content to own their own home and stop paying massive rents,”

Daft.ie found the total number of properties available to buy on June 21 was fewer than 12,500, down by over 6000 from the same period last year.

Mr Davitt said the Housing Commission now being set up by the Government needs to get to work and involve all stakeholders in the housing market, and it needs to find solutions urgently to the dearth of supply of homes,

"This crisis has been going on for far too long and people on average incomes are unable to acquire homes at a time when interest rates have never been so low, and the recent introduction of twenty and thirty year fixed interest rate mortgages.

The situation demands an unprecedented response from Government, not piecemeal measures aimed at the symptoms of the problem, which have in the past resulted in rent, and house price hikes."

“We need workable solutions to increase the supply of homes and at affordable prices.”

He said those solutions must involve State investment as recently recommended by the ESRI, planning issues, Local Authority utility investment and a review of the tax take on housing.

“We need to see supply ramped up so that the market develops in a sustainable way and avoids volatility,” he said.

€18k Made Available To Fund Midlands Age And Opportunity Programme

€18k Made Available To Fund Midlands Age And Opportunity Programme

Housing Minister Predicts Falling Midlands Homelessness

Housing Minister Predicts Falling Midlands Homelessness

€200,000 In Cash And Substantial Amount Of Drugs Seized In Laois

€200,000 In Cash And Substantial Amount Of Drugs Seized In Laois

Massive Laois Operation Leads To Multiple Arrests In Connection With Stolen Vehicles

Massive Laois Operation Leads To Multiple Arrests In Connection With Stolen Vehicles

Over 300 New Dwellings Completed In The Midlands This Year

Over 300 New Dwellings Completed In The Midlands This Year

Concerns Raised Over Emergency Power Plant In The Midlands

Concerns Raised Over Emergency Power Plant In The Midlands

National Ploughing Association Appoints New President, Chair And Vice-Chair

National Ploughing Association Appoints New President, Chair And Vice-Chair

Offaly Boy 'Raring To Go' After Life-Saving Procedure

Offaly Boy 'Raring To Go' After Life-Saving Procedure

Over €7m In Just Transition Funding For The Midlands

Over €7m In Just Transition Funding For The Midlands

Cancer Numbers Could Double By 2045 - Offaly Charity

Cancer Numbers Could Double By 2045 - Offaly Charity

First-Ever Laois Cost-Rental Homes Officially Opened

First-Ever Laois Cost-Rental Homes Officially Opened

Late Laois Two-Year-Old's Organs Used To Save Three Children

Late Laois Two-Year-Old's Organs Used To Save Three Children

State Expects To Exceed 2023 Midlands Housing Delivery

State Expects To Exceed 2023 Midlands Housing Delivery

Abolishment Of Carer's Means Test May Be Halted By "Permanent Government"

Abolishment Of Carer's Means Test May Be Halted By "Permanent Government"

Ryanair Calling On EU To Protect Flights Amid French Air Strikes

Ryanair Calling On EU To Protect Flights Amid French Air Strikes

Low Cost Home Heating Loans The Final Piece Of Retrofitting Jigsaw - Pippa Hackett

Low Cost Home Heating Loans The Final Piece Of Retrofitting Jigsaw - Pippa Hackett

Gardaí Advising Motorists To Avoid Midlands Road

Gardaí Advising Motorists To Avoid Midlands Road

Drugs Are Being Drone-Dropped Into Midlands Prison

Drugs Are Being Drone-Dropped Into Midlands Prison

Laois County Council Votes To Adopt New Local Area Plan

Laois County Council Votes To Adopt New Local Area Plan

100k Children Missed Out On Dental School Screening In 2023

100k Children Missed Out On Dental School Screening In 2023